Financial highlights

Our approach to business performance

Sales and profit growth and profit margins

Profitability and growth

We place primary importance on the sustainable growth of profit. While revenue growth is also essential, it is not our ultimate goal.

We focus on the operating profit margin as our primary profitability metric, targeting a benchmark of 10%. We aim to improve our gross profit margin by providing high value-added services and lower our SG & A expense ratio through efficient operations. The resources generated through the efforts are reinvested in human capital and system infrastructure, essential for continued growth.

Rather than focusing solely on profitability or growth, we aim to consistently achieve both of an operating profit margin of 10% and a net sales growth rate of over 10%.

Depending on the growth phase, we prioritize sales growth at the expense of profitability or accept slower growth to maintain margins. However, by flexibly adjusting our strategies in line with each growth phase, we will strive to balance profitability and growth while maximizing our corporate value.

Operating Income

Operating Income Rate

Profitability and capital cost

We are committed to sustainably maintaining and improving ROE and ROIC through profit growth.

At present, both indicators are showing a downward trend, as we have prioritized raising temporary staff's compensation ahead of client billing rates with the aim of securing job seekers. However, we aim to improve these indicators going forward and to maximize the spread over our weighted average cost of capital (WACC), thereby ensuring returns that exceed our capital cost.

We do not intend to improve these indicators by reducing net assets, as we believe such an approach does not contribute to genuine corporate value.

Consolidated financial figures

| Period | 40th Fiscal Year | 39th Fiscal Year | 38th Fiscal Year | 37th Fiscal Year | 36th Fiscal Year |

|---|---|---|---|---|---|

| Fiscal Year | FY2024 | FY2023 | FY2022 | FY2021 | FY2020 |

| Net Sales(In-house Research & Development Staff on Science)(million yen) | 51,136 (34,073) |

49,297 (33,485) |

47,602 (32,173) |

46,875 (31,523) |

44,126 (30,487) |

| Gross Margin(million yen) | 11,742 | 11,889 | 11,934 | 12,492 | 11,533 |

| Operating Income(million yen) | |||||

| Ordinary Income(million yen) | 5,095 | 5,505 | 5,614 | 6,393 | 5,243 |

| Ordinary Income Rate(%) | 10.0 | 11.2 | 11.8 | 13.6 | 11.9 |

| Net Income Attributable to Owners of The Parent Company(million yen) | 3,051 | 3,548 | 3,540 | 4,171 | 3,405 |

| Net Assets Amount(million yen) | 33,241 | 31,150 | 28,463 | 25,796 | 22,302 |

| Total Assets(million yen) | 41,753 | 39,827 | 36,198 | 33,828 | 30,619 |

| Operating Cash Flow(million yen) | 4,367 | 4,494 | 3,553 | 4,025 | 4,202 |

| Investment Cash Flow(million yen) | - 3,334 | - 713 | - 337 | - 6,104 | - 122 |

| Financial Cash Flow(million yen) | - 1,419 | - 1,240 | - 1,307 | - 870 | - 901 |

| Capital to Asset Ratio(%) | 76.4 | 75.4 | 76.3 | 74.2 | 71.2 |

| ROE (Return on Equity)(%) | 9.9 | 12.3 | 13.4 | 17.8 | 16.6 |

| ROA (Return on Assets)(%) | 7.5 | 9.3 | 10.1 | 12.9 | 11.9 |

| ROIC (Return On Invested Capital)(%) | 11.4 | 13.2 | 14.5 | 18.6 | 17.2 |

| WACC(Weighted Average Cost of Capital)(%) | 4.4 | 5.0 | 5.7 | 6.1 | 6.7 |

| Closing Market Price(yen) | 1,849 | 2,316 | 1,986 | 2,716 | 2,594 |

| BPS (Net Assets / 1 Share)(million yen) | 1,624.0 | 1,529.9 | 1,405.7 | 1,272.3 | 1,105.1 |

| P/B (Price Book-value Ratio) | 1.1 | 1.5 | 1.4 | 2.1 | 2.3 |

| Market Capitalization(million yen) | 37,090 | 46,458 | 39,839 | 54,482 | 52,035 |

| EPS (Current Net Income / 1 Share)(yen) | 155.3 | 180.6 | 179.8 | 211.3 | 171.8 |

| P/E (Price Earnings Ratio) | 11.9 | 12.8 | 11.0 | 12.9 | 15.1 |

| Dividend / 1 Share(yen) | 62.5 | 72.5 | 51.5 | 49.5 | 37.5 |

| Dividend / Total(million yen) | 1,227 | 1,423 | 1,013 | 977 | 741 |

| Dividend Payout Ratio(%) | 40.2 | 40.1 | 28.7 | 23.4 | 21.8 |

| Dividend Yield(%) | 3.4 | 3.1 | 2.6 | 1.8 | 1.4 |

| DOE (Dividend on Equity Ratio)(%) | 4.0 | 4.9 | 3.8 | 4.2 | 3.6 |

Net Sales

Net Sales

R&D Staff on Science

Gross Margin

Gross Margin

Gross Profit Margin

Operating Income

Operating Income

Operating Income Rate

Ordinary Income

Ordinary Income

Ordinary Income Rate

Net Income Attributable to Owners of The Parent Company

Net Income Attributable to Owners of The Parent Company

Net Profit Margin

ROE (Return on Equity)

ROE (Return on Equity)

ROA (Return on Assets)

ROA (Return on Assets)

ROIC (Return On Invested Capital)

ROIC (Return On Invested Capital)

Capital to Asset Ratio

Capital to Asset Ratio

Total Assets

Total Assets

Net Assets Amount

Net Assets Amount

BPS (Net Assets / 1 Share),EPS (Current Net Income / 1 Share)

BPS (Net Assets / 1 Share)

EPS (Current Net Income / 1 Share)

P/E (Price Earnings Ratio), P/B (Price Book-value Ratio)

P/E (Price Earnings Ratio)

P/B (Price Book-value Ratio)

※YE:Year-End

Dividend / 1 Share

Mid-term

Term-end

※ *:Forecast

Dividend / Total

Dividend / Total

※ *:Forecast

Dividend Payout Ratio, Dividend Yield

Dividend Payout Ratio

Dividend Yield

※ *:Forecast

Market Capitalization, Closing Market Price

Market Capitalization

Closing Market Price

※YE:Year-End

DOE (Dividend on Equity Ratio)

DOE (Dividend on Equity Ratio)

※ *:Forecast

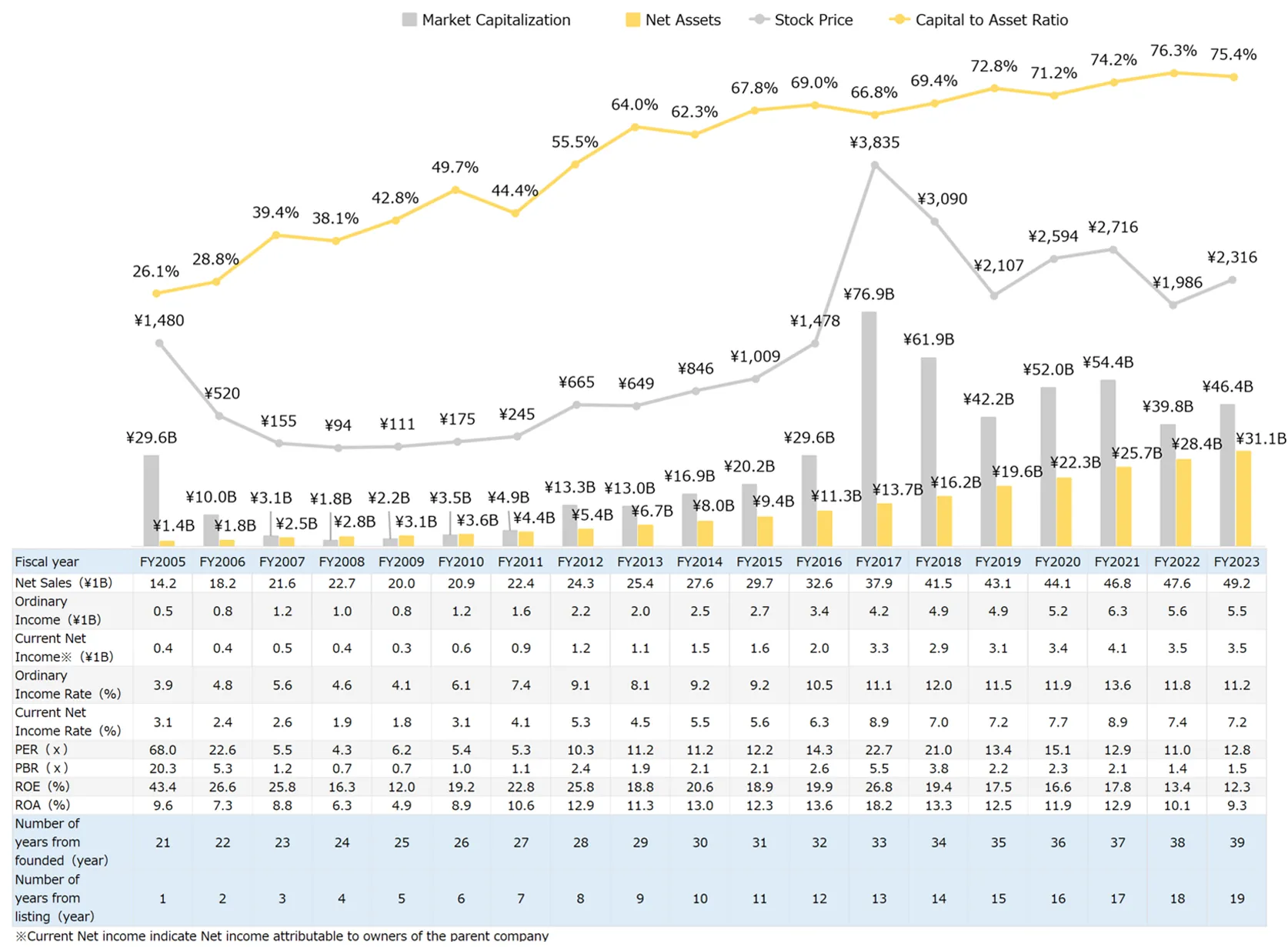

Various Indicators from Listing (2006) to The Present

Market Capitalization, Stock Price, PER (Price Earnings Ratio)

Market Capitalization

Stock Price

PER (Price Earnings Ratio)

Please refer to the following page for further information, click here (price information page on Yahoo Finance).

Actual results against projected figures

| Period | 41st Fiscal Year | 40th Fiscal Year | 39th Fiscal Year | 38th Fiscal Year | 37th Fiscal Year |

|---|---|---|---|---|---|

| Projections Announced | 2025 May 14 | 2024 May 14 | 2023 May 12 | 2022 May 13 | 2021 May 14 |

Net Sales

Plan

Result

Achievement Rate

Gross Margin

Plan

Result

Achievement Rate

Ordinary Income

Plan

Result

Achievement Rate

Net Income Attributable to Owners of the Parent Company

Plan

Result

Achievement Rate

About WDB Holdings

Financial Information

Stock Information